📍Stake Feature

The Shade App offers a staking feature that allows you to earn a share of the Protocol's revenue by staking your SHD tokens. By staking your tokens, you actively participate in securing the network and contribute to its stability. Staking not only incentivizes holders to maintain their investment but also plays a crucial role in governing the network and facilitating decentralized decision-making processes.

There is a 7-day unbonding period when you choose to unstake your tokens, meaning it will take 7 days for your staked SHD to become liquid again after initiating the unstaking process.

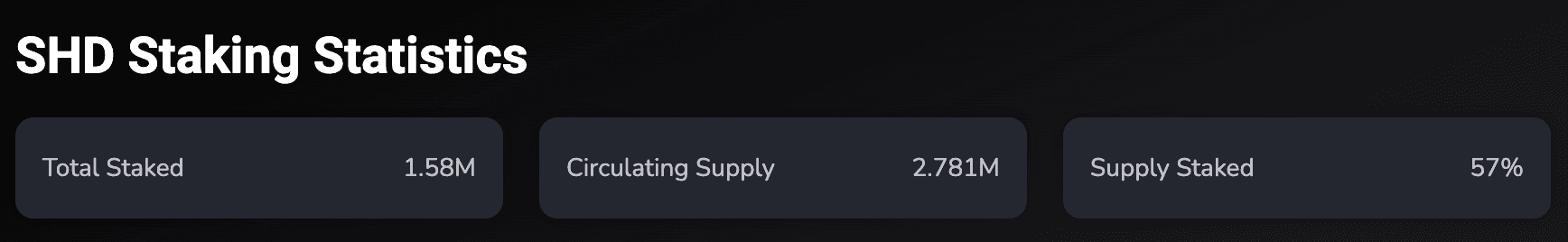

How much SHD is staked?

The amount of SHD that is currently staked fluctuates based on the number of users participating in staking at any given time. You can check the total amount of staked SHD on the Shade App's staking page: https://app.shadeprotocol.io/stake

Why does the APY% fluctuate

The Annual Percentage Yield (APY) in $SHD staking campaigns is subject to fluctuations based on users' actions such as bonding or unbonding their SHD tokens. For instance, let's consider a scenario where there are 1 million SHD tokens staked with an initial APY of 15% at the onset of a new campaign week. During this week, the APR can vary depending on user activities.

If individuals stake additional SHD tokens, it leads to a decrease in APY as the rewards are distributed among a larger pool of staked tokens. Conversely, if users unbond their SHD tokens, the APR increases since the rewards get distributed among a smaller pool. At the start of the next campaign week, if there are no changes in staked SHD tokens and the distributed rewards increase, the APR may rise to 20%.

In subsequent weeks, if no alterations occur in the staked SHD tokens, the APY remains stable. However, any changes in staking behavior during the week can influence the APRY accordingly – staking more SHD would decrease the APR, while unbonding SHD would increase it. Thus, the APR in $SHD staking campaigns dynamically adjusts based on users' staking activities and the amount of rewards generated from dApp revenue.

Information provided in this post is for general informational purposes only and does not constitute formal investment advice. Please read the full disclaimer at shadeprotocol.io/disclaimer before relying on any information herein.

Last updated